Our COVID-19 Preparedness

Commitment to client safety

We remain committed to providing excellent service to our clients in the safest way possible. We closely monitor guidelines and recommendations from the CDC and other federal and state health agencies.

Currently, the tax side is continuing our pause from seeing clients in-person until the end of February. In early March, we will re-assess the COVID situation, and will communicate with our clients via email and our website if there will be any changes to our COVID policy. Virtual options will always be available if you prefer.

For tax preparation appointments, refer to our Frequently Asked Questions for working with us during COVID-19.

To request a Financial Planning or Investment Management appointment, kindly call our office at 203.271.3801, extension 316, or contact us via email.

How to work with us

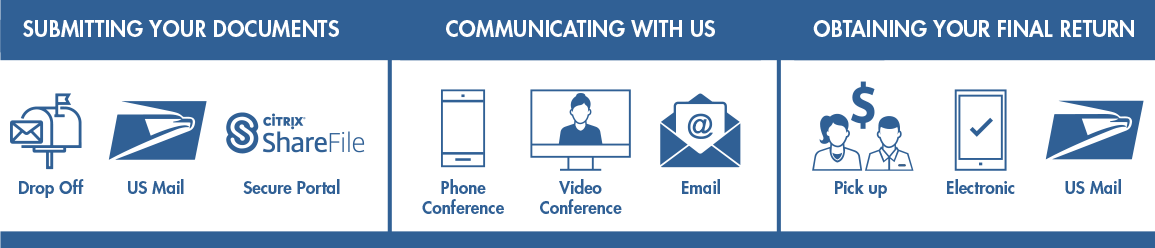

As today’s COVID situation dictates, we are minimizing our face-to-face appointments this tax season. Alternately, we offer other opportunities to engage with us:

We ask to refrain from “dropping in” our office, as you will not be able to speak with staff directly. To leave documents, please use the secure mailbox outside the entry door.

As a reminder, please wait to obtain all documents you expect and provide to us as a complete set. Do not provide us documents one at a time.